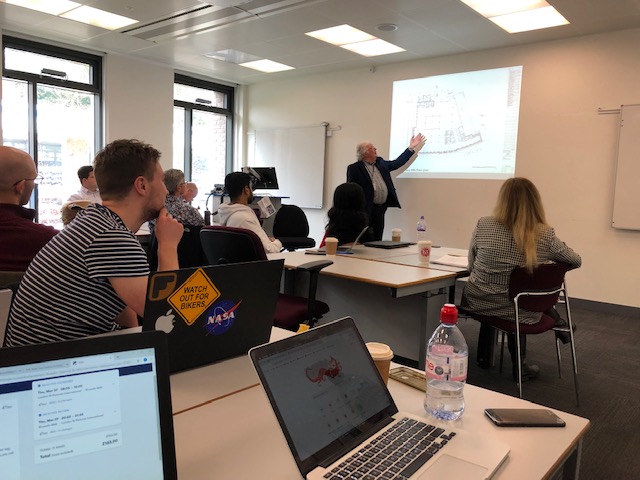

Earlier this month, M.S. in Real Estate students had the opportunity to study abroad in the historically rich city of London. Students visited with developers, city planners and appraisers to understand the dynamics of the British real estate market and the differences of the development process in the United States. After returning form the trip, James Scruggs, Mike Sullivan and Chris Manniz wrote a review of the three major differences between the US and UK in terms of development standards and practices.

"In our view, there are three major differences between the U.S. and U.K. in terms of development standards and practices: parking enhancements, public stakeholder equity and financial technology in their underwriting."

Parking

Possibly the most glaring distinction between US and UK development pertains to parking standards. While apportioning space for parking within an urban development project often represents a huge challenge in the US, such is not the case in London, which has an entirely different view on the use of cars in its dense metropolitan area. With limited land and a housing shortage, London developers routinely exclude parking. Indeed, they would have to argue for its inclusion in front of the planning council—and likely without much success. We noted this in our site visits to current developments, as well as when designing and underwriting our project with the Kingston students. If we had similar parking-related standards in Charlotte, we could build more units per acre and most likely receive higher IRR’s on our deals as a result of (a) extra income from additional units, and (b) less money spent concrete parking structures.

Public stakeholder equity

In short, public entities in the US and UK approach development projects differently. In the US, it is typical for the city, state, or county to sell off a piece of land to a developer and use the proceeds to reinvest in the community. In contrast, the public entity in London will remain in the deal and participate in the profit sharing at the back end of the sale. When we toured Elephant and Circus, we discussed how that profit positively impacted the community. Specifically, the city made £33MM at the back end of an apartment building sale and immediately reinvested the proceeds by building a £30MM health center. In essence, by working judiciously with the developer and being patient in receiving funds, the council was able to positively impact the community with their development plans—and still have an additional £3MM to reinvest elsewhere. We agreed that this represents an excellent strategy for approaching development as a public stakeholder, and should be considered more widely in the US.

Financial Technology

About MSRE International Study Program

This course offers a unique opportunity to learn directly from one of the world's most advanced and competitive environment. The course is required for MSRE students, but is an optional course for students in the Certificate, MBA and other graduate programs in the Belk College of Business. Locations visited in the past include Cape Town, Istanbul, Bangkok, Ho Chi Mihn, Hong Kong, Rio de Janeiro, Moscow, Dubai, Kuala Lumpur, Shanghai, Berlin and Barcelona.To request information, contact Elona Ellis.

About the Childress Klein Center for Real Estate

The mission of the Childress Klein Center for Real Estate is to advance knowledge in real estate, public policy and urban economics through graduate education, applied research, and industry/community collaboration. The Center was established in 2005 with support from the real estate industry and program alumni. Their financial contributions have supported course development, scholarships for incoming graduate students, special events, and community outreach activities. The Center administers the M.S. in Real Estate program, the MBA concentration and the Graduate Certificate programs in real estate finance and development, and manages programming and outreach to the Real Estate Alumni Association and Real Estate Advisory Board. The center, part of the Belk College of Business at UNC Charlotte, has been ranked among the 20 most active research institutions in real estate for the past decade.